Bank of America exceeded second-quarter revenue and profit expectations, buoyed by increased investment banking and asset management fees.

Bank of America exceeded second-quarter revenue and profit expectations, buoyed by increased investment banking and asset management fees.

Earnings reached 83 cents per share, surpassing the estimated 80 cents per share by LSEG, with revenues hitting $25.54 billion against an expected $25.22 billion.

Despite a 6.9% decline in profit to $6.9 billion year-over-year, translating to 83 cents per share due to lower net interest income amid rising interest rates, revenues saw a marginal increase of under 1%.

The bank attributed its success to a 29% surge in investment banking fees, totaling $1.56 billion, which edged past StreetAccount’s $1.51 billion estimate.

Asset management fees also rose by 14% to $3.37 billion, bolstered by increased stock market values, enabling the wealth management division to achieve a 6.3% revenue rise to $5.57 billion, closely aligning with estimates.

Net interest income declined by 3% to $13.86 billion, in line with StreetAccount’s forecast.

However, renewed guidance on net interest income provided optimism to investors, signaling an imminent turnaround.

Net interest income, crucial for bank profitability, is expected to reach approximately $14.5 billion by the fourth quarter of this year, as outlined in Bank of America’s slide presentation.

This reaffirms earlier executive assurances that net interest income would likely bottom out in the second quarter.

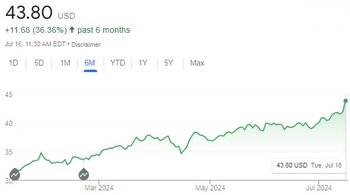

Bank of America’s shares surged 4.4% following this positive NII outlook.

Last week, JPMorgan Chase, Wells Fargo, and Citigroup also exceeded business revenue and profit expectations, continuing a streak upheld by Goldman Sachs on Monday, supported by a resurgence in Wall Street activities.

You May Also Like: US Banks Face Higher Risks Amid Economic Uncertainty, Fed’s Stress Test Reveals